Key Service Offerings

We work with our clients to guide them through complex and difficult situations in life, and make the seemingly complicated, simple.

These are our areas of specialty…

Financial planning involves an evaluation of a Client's current and future financial state by using currently known variables to predict future cash flows, asset values, and withdrawal plans.

For clients seeking only investment advice and management, our firm provides continuous advice to a Client regarding the investment of Client funds based on the individual needs of the Client.

Our financial check up service is a limited financial planning engagement with no follow up services. This service consists of extensive analysis and a two hour review of up to two specific areas of financial planning.

What To Expect

Chat

Schedule a complimentary Introductory Chat to get acquainted and talk about your finances, goals, and uncover your challenges.

Explore

A series of four meetings to get to know one another, set goals, and develop an execution plan.

Execute

We implement the plans from Step Two, take action on them, and prioritize the most important steps.

Our Detailed Process

“It is good to have an end to journey towards; but it is the journey that matters, in the end.”

~Ursula K. Le Guin

Step One

- Schedule a complimentary Introductory Chat to get acquainted and talk about your finances, goals, and uncover your challenges.

Step Two

- Exploration Meeting. This establishes the foundation for our relationship and work together.

- Vision Meeting. We spend an extended time together in order to sketch out in detail what the life of your dreams really looks like to you.

- Obstacles Meeting. We dig into what your biggest road blocks – both known and unknown – may be and how to overcome them.

- Knowledge Meeting. This is where we bring decades of practice, expertise, and professional development to address the major areas of your financial path. That includes cash flow and budgets, insurance and risk management, investments, stock options, tax planning, and estate and legacy considerations.

Step Three

- Execution. We implement the plans from Step Two, take action on them, and prioritize the most important steps as well as schedule the others for implementation. Together, we keep you accountable to achieve successes and navigate changes as they arise throughout your life.

Then What?

- We meet regularly – 3 times a year – to check in on progress and how your goals evolve and change over time. You enjoy the peace of mind that accompanies work with a financial coach to manifest your most important dreams.

Our Fees

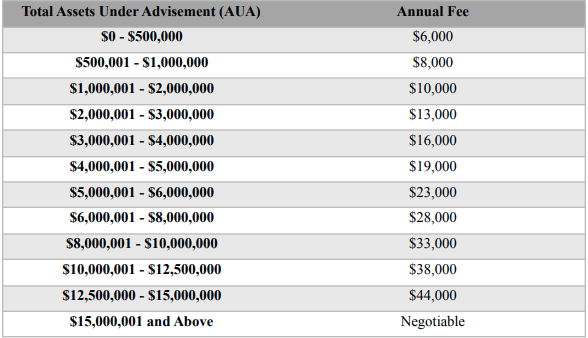

Financial Life Management

Financial Life Management includes Financial Planning and gives clients the choice to include Discretionary Investment Management. Fees for Financial Life Management consist of an initial fee up to $2,500, depending on complexity of the client, and an ongoing fee based on total Assets Under Advisement (AUA) and Assets Under Management (AUM). The fee is paid quarterly in advance. Clients who choose to also engage THG for Discretionary Investment Management as described in Item 4 of our ADV, may have their AUM fees applied towards their Financial Life Management fee. The amount of the Financial Life Management fee will be reviewed and adjusted at least every 2 years.

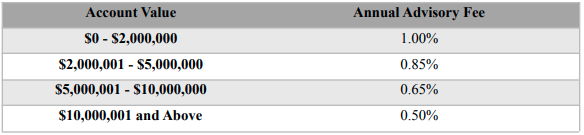

Discretionary Investment Management

The fee is based on a percentage of assets under management (AUM) and may be negotiable in certain cases. The annualized fees for discretionary investment management services are based on the following fee schedule:

The annual advisory fee is paid quarterly, in advance, based on the value of the account on the last business day of the prior quarter. The advisory fee is a blended fee schedule and may be negotiable. No increase in the annual fee shall be effective without agreement from the Client by signing a new agreement or amendment to their current advisory agreement.

Financial Check Up

The Financial Check Up service is a limited-scope, six-month planning engagement, with a fixed fee in the amount of $2,500, paid in advance. No follow up services are provided with the Financial Check Up service. The fee may be paid either by check or through an unafiliated payment processing service. After the Financial Check Up service is completed, if the Client decides to engage THG under the Financial Life Management service, then the Financial Check Up fee will be applied to the Financial Life Management service fee.